Course

Materials

This Course is for income tax computation for the Financial Year 2017-18 and Assessment Year 2018-19.

This course does not covers current tax laws although it may be useful for many students.

Notes will be available for tax provisions only and user will be required to purchase a book separately for practical questions, authored by ‘Dr. Girish Ahuja’

Please use your discretion while subscribing this course.

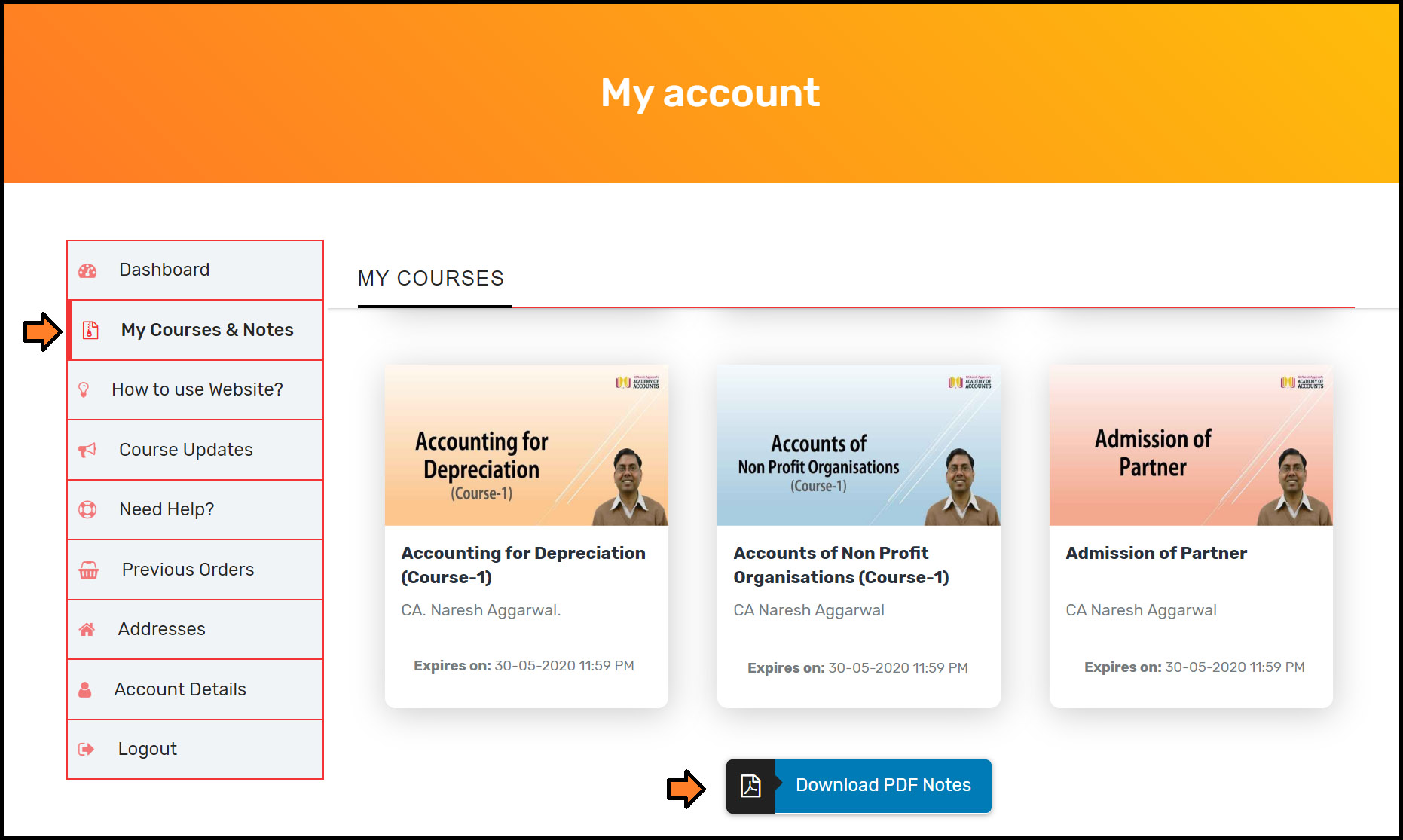

Student will be able to download PDF Notes related to the course after subscribing to this course. The location of the download link is shown in the below-mentioned image :

Course Content

Expand All

CHAPTER 01 : INTRODUCTION

CHAPTER 02 : RERIDENTIAL STATUS

Lesson Content

0% Complete

0/4 Steps

Lesson Content

0% Complete

0/7 Steps

Lesson Content

0% Complete

0/3 Steps

CHAPTER 03 : HOUSE PROPERTY

Lesson Content

0% Complete

0/5 Steps

Lesson Content

0% Complete

0/4 Steps

Lesson Content

0% Complete

0/5 Steps

Lesson Content

0% Complete

0/8 Steps

CHAPTER 04 : CAPITAL GAINS

Lesson Content

0% Complete

0/4 Steps

Lesson Content

0% Complete

0/4 Steps

Lesson Content

0% Complete

0/5 Steps

Lesson Content

0% Complete

0/5 Steps

CHAPTER 05 : BUSINESS OR PROFESSION (EXCLUDING COMPUTATION OF PROFIT)

Lesson Content

0% Complete

0/5 Steps

Lesson Content

0% Complete

0/4 Steps

Lesson Content

0% Complete

0/3 Steps

CHAPTER 06 : SALARY

Lesson Content

0% Complete

0/4 Steps

Lesson Content

0% Complete

0/5 Steps

Lesson Content

0% Complete

0/1 Steps

Lesson Content

0% Complete

0/3 Steps

Lesson Content

0% Complete

0/3 Steps

CHAPTER 07 : OTHER SOURCES OF INCOME

CHAPTER 08 : DEDUCTIONS

Lesson Content

0% Complete

0/5 Steps

Lesson Content

0% Complete

0/4 Steps

CHAPTER 09 : CLUBBING OF INCOME

CHAPTER 10 : SET OFF AND CARRIED FORWARD

CHAPTER 11 : AGRICULTURE INCOME

Lesson Content

0% Complete

0/3 Steps

CHAPTER 12 : ASSESSMENT OF INDIVIDUAL

Lesson Content

0% Complete

0/4 Steps

Login

Accessing this course requires a login, please enter your credentials below!